DSCR Loans

Simplified Financing for Real Estate Investors

What Are DSCR Loans?

Debt Service Coverage Ratio (DSCR) loans are designed for real estate investors who want to qualify for financing based on the cash flow of the investment property rather than their personal income. These loans make it easier for investors to build their portfolios without needing extensive documentation like tax returns or W-2s.

Why Choose a DSCR Loan?

DSCR loans focus on the property’s ability to generate income, making them a straightforward option for investors. With no personal income verification required, they streamline the process, enabling investors to focus on finding and acquiring profitable properties.

Key Benefits of DSCR Loans

Income-Based Qualification: Eligibility is determined by the property’s cash flow (rent vs. mortgage payment), not the borrower’s personal income.

No Tax Returns or W-2s Needed: Simplified documentation makes the process faster and less complicated.

Flexible Financing Options: Available for residential and commercial properties, these loans cater to a wide range of investment strategies.

How Do DSCR Loans Work?

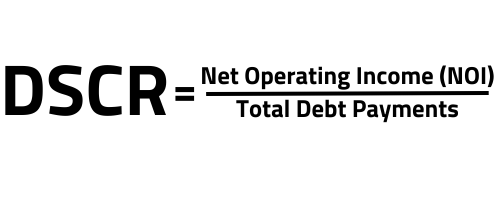

DSCR loans assess the property’s income potential through the Debt Service Coverage Ratio, calculated as:

For example, a DSCR of 1.25 means the property generates 25% more income than needed to cover the debt. Most lenders require a minimum DSCR of 1.0 to 1.25, depending on the property type and loan terms.

Who Qualifies for a DSCR Loan?

DSCR loans are ideal for:

Real estate investors purchasing rental or income-generating properties.

Borrowers who prefer not to rely on personal income documentation.

Individuals with strong credit but non-traditional income sources.

When Should You Consider a DSCR Loan?

DSCR loans are perfect if you:

Want to expand your real estate portfolio.

Own multiple properties and need a simplified qualification process.

Plan to purchase a property based on its cash flow potential.

Why Work With Us for Your DSCR Loan?

We specialize in DSCR loans and understand the needs of real estate investors. Our team ensures a seamless application process with tailored loan solutions that maximize your investment potential.

Build Your Real Estate Portfolio Today

DSCR loans offer real estate investors the flexibility to qualify based on cash flow, not personal income. Contact us today to learn more, evaluate your property’s potential, and secure financing for your next investment.

Thank you for choosing us. We are dedicated to helping you achieve your homeownership goals with personalized service and expert guidance. For more information or assistance, feel free to reach out to us anytime!

© Copyright Simple Mortgage Solutions LLC 2025. All rights reserved.

Simple Mortgage Solutions, LLC NMLS 1983670 is a licensed mortgage loan originator representing UWM Lending. Licensed in AR, TN, FL, LA, MS, CO